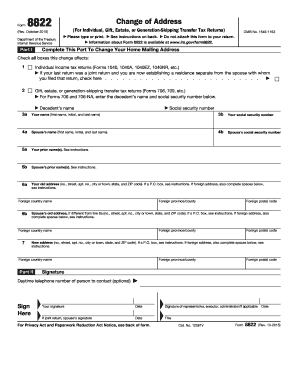

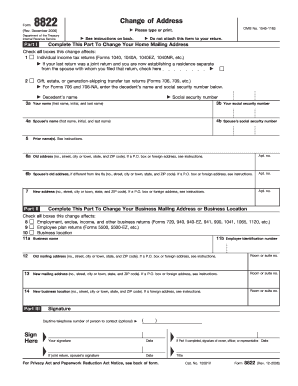

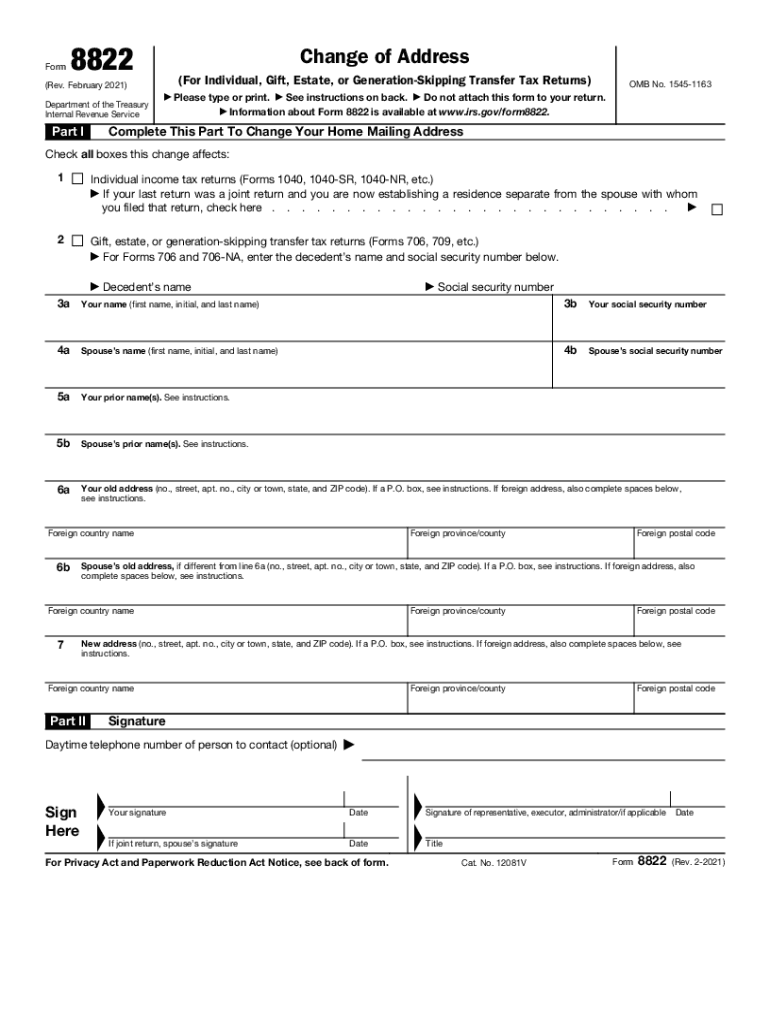

IRS 8822 2021-2026 free printable template

Instructions and Help about IRS 8822

How to edit IRS 8822

How to fill out IRS 8822

Latest updates to IRS 8822

All You Need to Know About IRS 8822

What is IRS 8822?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

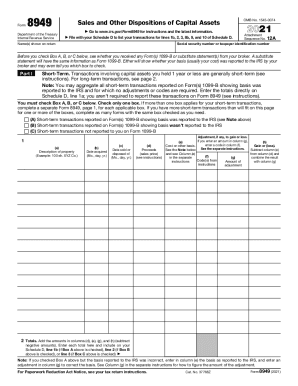

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8822

What should I do if I made a mistake on my IRS 8822 after submitting?

If you've discovered an error after filing your IRS 8822, you can rectify it by submitting a corrected form. Ensure that you mark the form as 'Amended' and clearly indicate the corrections made. Additionally, it's advisable to keep copies of both the original and amended submissions for your records.

How can I verify if my IRS 8822 has been received or processed by the IRS?

To check the status of your submitted IRS 8822, you can contact the IRS directly or utilize the IRS online tools where available. For e-filed submissions, be aware of common rejection codes, and if rejected, follow instructions provided for re-submission.

What should I do if I receive a notice from the IRS regarding my IRS 8822?

Receiving a notice related to your IRS 8822 requires a prompt response. Carefully review the notice for specific instructions, gather any requested documentation, and respond within the given timeframe to avoid further complications. It's important to address discrepancies or inquiries directly with the IRS.

How long should I retain records related to my IRS 8822?

Record retention for your IRS 8822 is essential for compliance and reference. Generally, you should keep copies of your forms and any related documentation for at least three to seven years, depending on your specific tax and filing situation. Make sure to store them securely to protect your personal information.

What are some common mistakes to avoid when filing IRS 8822?

Common mistakes when completing your IRS 8822 include misreporting your new address, failing to sign the form, or not providing adequate identification information. Double-check all entries and ensure all required sections are completed to avoid delays or rejections.

See what our users say