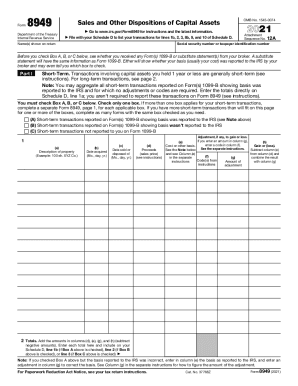

IRS 8822 2021-2025 free printable template

Show details

Generally it takes 4 to 6 weeks to process a change of address. Changing both home and business addresses Use Form 8822-B to change your business address. Do not attach this form to your return. Information about Form 8822 is available at www.irs.gov/form8822. If you are a representative signing for the taxpayer attach to Form 8822 a copy of your power of attorney. Purpose of Form You can use Form 8822 to notify the Internal Revenue Service if you changed your home mailing address. If you...

pdfFiller is not affiliated with IRS

Federal form 8822 2025 instructions and help

How to edit printable IRS form 8822 2025

How to fill out form 8822 online

Video instruction

Federal form 8822 2025 instructions and help

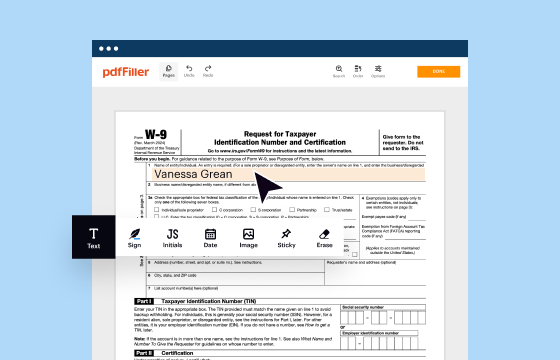

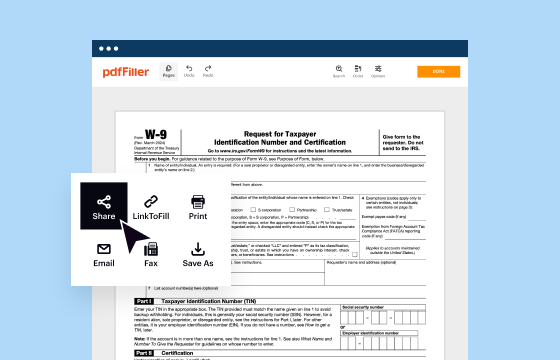

Boost your productivity and save time printing out and sending your documents. Handle your tax forms online with pdfFiller.

How to edit printable IRS form 8822 2025

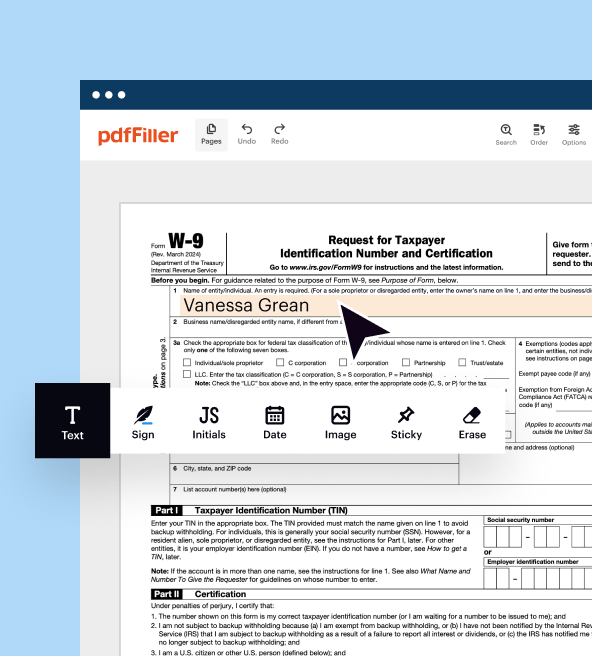

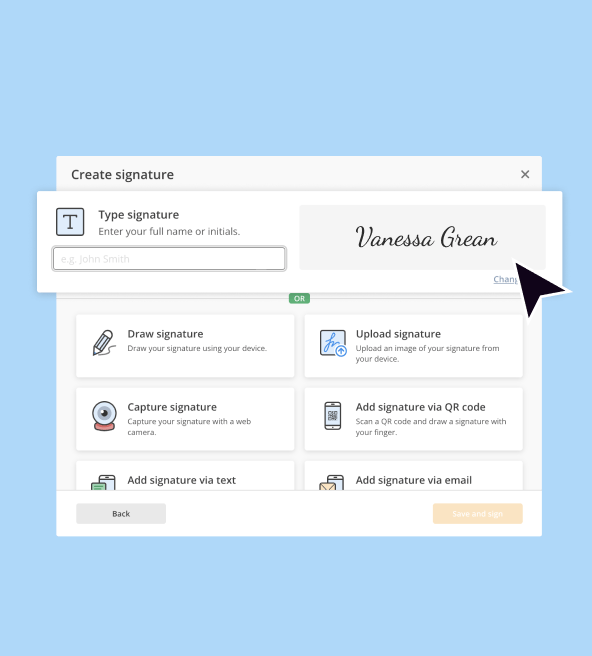

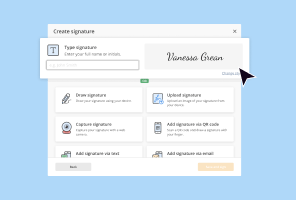

Discover the benefits of using pdfFiller editor and streamline document editing and completion in just 4 steps:

01

Register or log in to your account. Access your account and start a free 30-day trial to explore pdfFiller functionality.

02

Upload your document. Click Get Form and the top of the page to start editing IRS form 8822.

03

Edit the form. Prepare your document: add fillable fields, rotate or add pages, insert images and stamps, and more.

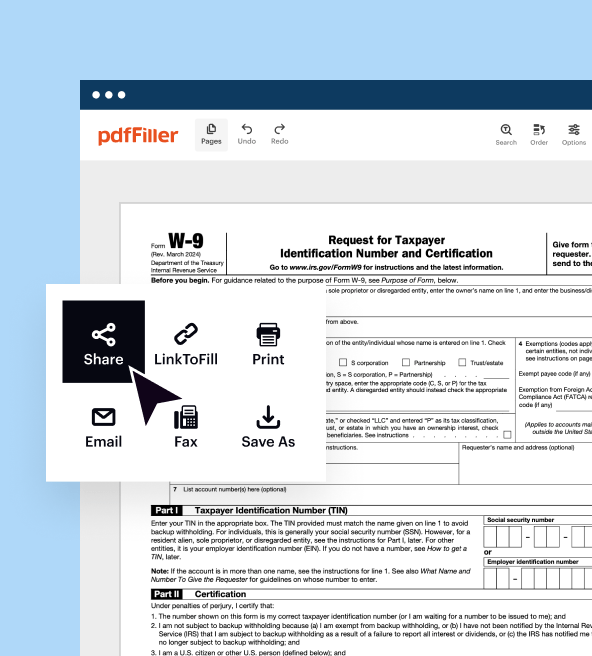

04

Complete the form and share it. Fill out your form and share it via email, link to fill request, or send it directly to the IRS.

Simplify your daily document management with pdfFiller.

How to fill out form 8822 online

Gather the information and complete your form with ease online.

01

Begin by visiting the IRS website or using the official IRS 8822 Change of Address form.

02

Provide your personal information, including your name, social security number, old address, and new address.

03

Double-check all the information you have entered to ensure accuracy.

04

Sign and date the change of address form.

05

Submit the form through the designated method (online, mail, or fax) as specified by the IRS.

Video instruction

Show more

Show less

New Updates to 8822

Changes to 8822 form PDF 2025

New Updates to 8822

Changes to 8822 form PDF 2025

Form 8822 is up-to-date and has not undergone any additional changes. The current version can be checked at the official IRS website.

All You Need to Know About IRS Form 8822

What is the tax form 8822 form purpose?

Who needs 2025 form 8822?

What information do you need to provide in fillable IRS form 8822?

Is IRS form 8822 2025 accompanied by other forms?

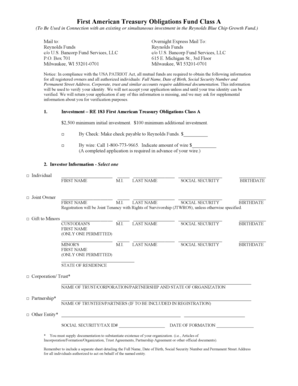

IRS form 8822 and its Components

When is the 8822 form due date?

Where do I send form 8822?

All You Need to Know About IRS Form 8822

The purpose and ways of managing form 8822 are straightforward: it should be obtained and completed in case you need to notify the IRS about the address change. Get 8822 form 2025 PDF, fill it out, and share it with the IRS immediately.

What is the tax form 8822 form purpose?

The criteria for filling out Form 8822 depend on whether the taxpayer has a change in home or business address. Specifically, this form should be completed and sent to the IRS to report a change in home mailing address, business location, or identity of a responsible party. It should be noted that Form 8822 has different sections for individual taxpayers, business taxpayers, and representative or appointed parties.

Who needs 2025 form 8822?

01

Individuals who recently moved to a new address.

02

Taxpayers who have changed their mailing address or contact information.

03

Businesses or organizations that have relocated to a different address (Form 8822-B).

What information do you need to provide in fillable IRS form 8822?

When completing your 8822 form, you need to provide the following information:

01

Basic Personal Information: Name, Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN).

02

Previous and New Addresses: Include details like prior name, old address, apartment numbers, or P.O. boxes if applicable.

03

Signature: This is required from the taxpayer, executor, or authorized representative. If the form is for a joint return, both spouses must sign if they still share the same residence. If not, each spouse must file separately.

Is IRS form 8822 2025 accompanied by other forms?

There are no other requirements for submitting a change of address, IRS form 8822. For those who experience changes in their business address, or a change of the person responsible, they should use Form 8822-B, which is an equivalent form designed for business entities. If a representative signs the form on behalf of the taxpayer, they must attach a copy of a power of attorney document. To do this, the representative can use form 2848.

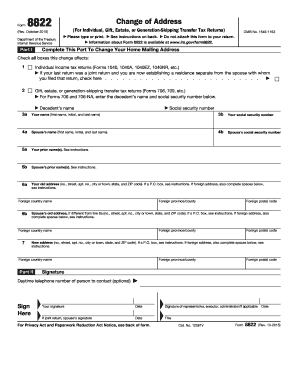

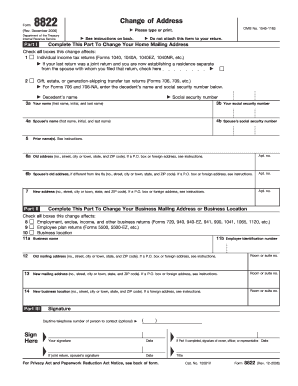

IRS form 8822 and its Components

Part I: Change of Home Mailing Address

01

Individual income tax returns (Forms 1040 series).

02

Gift, estate, or generation-skipping transfer tax returns (e.g., Forms 706, 709). For estate returns, provide the decedent's name and SSN.

Personal Information:

01

Taxpayer's and spouse’s full names and Social Security Numbers (SSNs).

02

Any prior names (for both taxpayer and spouse).

03

Old address details for both the taxpayer and spouse, with instructions for P.O. box or foreign addresses.

04

New Address: Enter the new mailing address (street, city, state, ZIP code), including fields for foreign addresses if applicable.

Part II: Signature

Signature Section:

01

Signature of the taxpayer, spouse (if applicable), or authorized representative.

02

Optional daytime phone number for contact.

When is the 8822 form due date?

The use of IRS form 8822 is voluntary, so there is no deadline to meet. However, it is advisable to file it. Suppose you fail to notify the Internal Revenue Service of your new mailing address. In that case, you may not receive an important notice from the agency, for instance, a demand for tax or a deficiency notice. Please remember it may take up to six weeks to process your request for a change of home address.

Where do I send form 8822?

If your address changes affect forms 706, 709, etc., you will need to send your form 8822 to the Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0023.

If your home mailing address change does not affect the returns mentioned above, you will need to send the 8822 IRS form to one of the places specified in the table on page 2 of the form. Find the state of your old address in the left column, and use the corresponding address from the right column to send the form.

Show more

Show less

FAQ

What if my authorized representative is making the change of address on my behalf?

Authorized representatives who wish to change a taxpayer's address must submit Form 2848, which designates them as the official agent for the taxpayer. It is important to note that individuals who are not authorized representatives—such as friends, family members, or other third parties—are not permitted to request changes to a taxpayer's address. This process ensures that only designated individuals can update sensitive taxpayer information.

Can I change my address by phone?

It is an option for address change instead of completing federal form 8822. Inform the IRS directly, either in person or by telephone. You’ll need to verify your identity by providing your full name, old and new addresses, and SSN, ITIN, or EIN.

What is the difference between Form 8822 and 8822 B?

IRS Form 8822-B is different from IRS form 8822 2025. Businesses use the 8822-B form to update business address information with the IRS. Individuals use the 8822 form to update their personal address information with the IRS.

How to add and edit fillable fields to the form?

Once your form is uploaded to our online editor, select the Edit Fillable Fields menu on the left. Select options to add text, eSignature, number, date, and other fillable fields. If you don’t need to add new fields, you can simply start filling out the form.

Can I merge several documents?

Go to the Dashboard, select the document you want to merge, click on the three dots on the left, and choose Merge. Then add other files you want to add and click Merge Now. Download your new document and save it to your device or one of the cloud storage options.

Is it possible to add annotations or comments in a PDF?

Yes, you can add annotations like comments, highlights, or shapes to a PDF in pdfFiller. Use the annotation tools to mark important sections, add notes, or emphasize text in the document.

Can I password-protect my tax form 8822 documents in pdfFiller?

When sharing the document, you can select the Link to Fill option and change security settings. You can add an expiration date, a signature stamp, and a password for trusted parties to access.

Fill out IRS form 8822